BY RSH Inc IN RSHinc On 17-10-2015

Oil prices have been on the news consistently for the last several months with some banks analysts such as Goldman Sachs saying that oil will be $20 in no time, while others saying oil is going to $70.

But why does this matter to you, or to us?

Oil as a commodity is a major export for many countries such as Canada, Venezuela, Russia, and many more, and represents a

significant part of their income as they possess large amounts which they’re able to harvest for relatively low costs.

When oil is priced low, as in the supply is significantly higher than the demand as it currently is, the price of gasoline at the pump is significantly reduced making many happy, but what isn’t realized is that this low price also has a global economic pull, and in many cases has severe effects on the major exporters due to the overhead profit per barrel harvested being reduced.

As oil stands at $44 many of the major oil producing countries and private companies are losing money per barrel harvested, and in turn major oil companies such as Exxon, Chevron, etc are forced to close rigs, and fire employees so as to reduce profit loss as much as possible; should this trend continue there would be major adverse effects on the global economy.

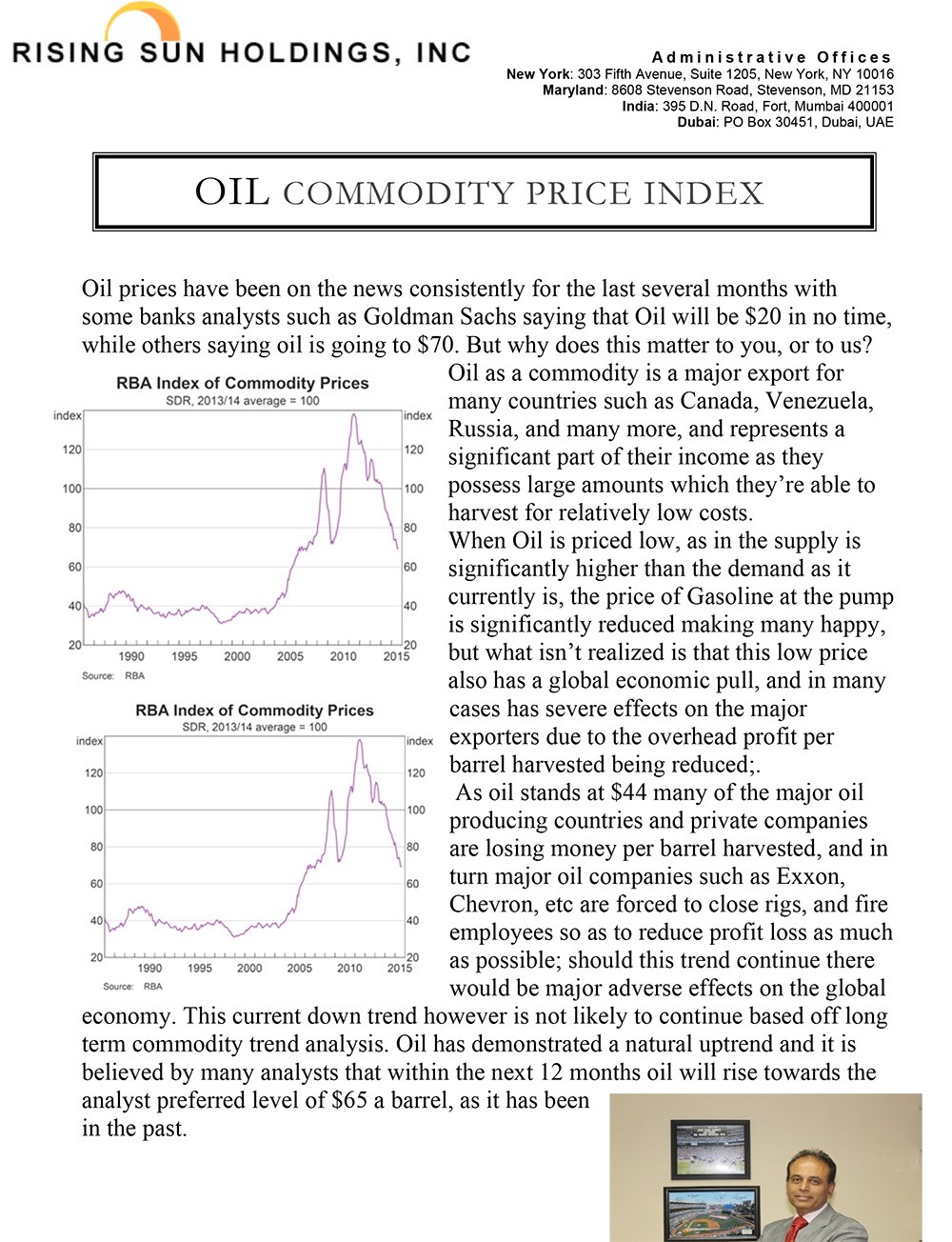

This current down trend however is not likely to continue based off long term commodity trend analysis.

Oil has demonstrated a natural uptrend and it is believed by many analysts that within the next 12 months oil will rise towards the analyst preferred level of $65 a barrel, as it has been in the past.

October 17, 2015

October 17, 2015 By admin

By admin