Price targets in this article rely on assumptions made regarding the total addressable markets (TAMs) and penetration rates discussed below. Bitcoin may fail to reach these price targets if any of the TAMs or penetration rates are not met. Risks and limitations exist that may prevent our forecasts from being realized.

In ARK’s Big Ideas 2025 report, we updated our bitcoin price targets for 2030, projecting bear, base, and bull cases of ~$300,000,~$710,000, and ~$1.5 million per bitcoin, respectively, as shown below.

.png)

Source: ARK Investment Management LLC, 2025. This ARK analysis is based on a range of external sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. This forecast relies on data that have not been verified, and are subject to numerous criteria, assumptions, risks, and limitations that are inherently uncertain, and there will be variations with real life that could cause substantially different results. The forecast includes assumptions on the future use cases for bitcoin and the levels at which those use cases will contribute to bitcoin’s price appreciation, which are subject to change or revisions over time, that are influenced by ARK’s subjective judgments and biases that heighten the risks and limit the uses of the forecast as a decision-making tool. Given the unpredictable nature of markets and other future events, relying on forecasts is inherently risky. While we believe that there is a sound basis for the forecasts presented, they are provided for illustrative purposes only and no representations are made as to their accuracy.

This article unpacks the modeling methodology and assumptions supporting those price targets, including the expected total addressable markets (TAMs) and penetration rates.

Price Targets And Assumptions

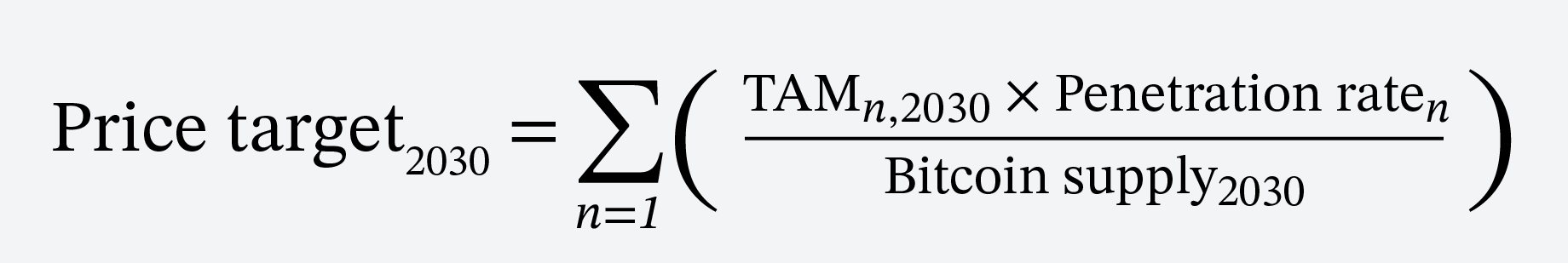

Our price targets are the sum of TAM (Total Addressable Market) contributions at the end of 2030, based on the following formula:

Our supply estimate is based on bitcoin’s deterministic issuance schedule, which will approach ~20.5 million units by 2030. Each variable contributes to the price target as follows:

Anticipated contributors to capital accrual (primary):

- Institutional investment, primarily through spot ETFs.

- Referred to by some as “digital gold,” bitcoin is a nimbler, more transparent store-of-value relative to gold.1

- Emerging market investors seeking a safe haven that can protect them against inflation and devaluation.

Anticipated contributors to capital accrual (secondary):

- Nation-state treasuries, as other countries follow the US with bitcoin strategic reserves.

- Corporate treasuries, as more companies diversify fiat cash with bitcoin.

- Bitcoin on-chain financial services, as Bitcoin substitutes for legacy finance.

Excluding digital gold, which our model penalizes because it is the most direct, zero-sum competitor to bitcoin, we assume conservatively that the TAM of the contributors listed above (specifically 1, 3, 4, and 5) grows at a compound annual growth rate (CAGR) of 3% over the next six years. For the sixth contributor—bitcoin’s on-chain financial services—we assume a 6-year CAGR ranging from 20% to 60%, relative to the value accrued as of year-end 2024, as follows:

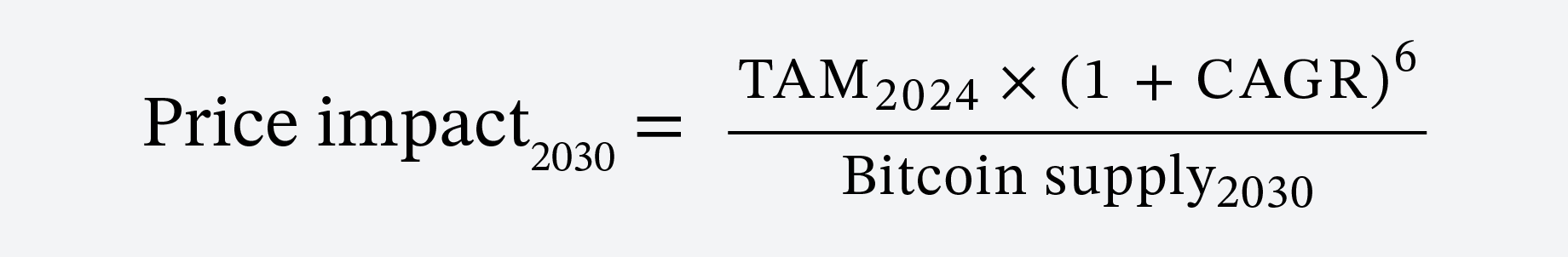

Finally, we delineate the TAM and penetration rate contributions to the bear, base, and bull price targets, respectively, as follows:

Source: ARK Investment Management LLC, 2025. This ARK analysis is based on a range of external sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security or cryptocurrency. Forecasts are inherently limited and cannot be relied upon.

As shown in the chart above, digital gold contributes the most to our bear and base cases, while institutional investment contributes the most to our bull case. Interestingly, nation-state treasuries, corporate treasuries, and Bitcoin’s decentralized financial services contribute relatively little in each case.

Read m0re : https://www.ark-invest.com/articles/valuation-models/arks-bitcoin-price-target-2030

April 28, 2025

April 28, 2025 By admin

By admin